Capital Gains Tax On Antique Cars

Home » Apartment » Capital Gains Tax On Antique CarsYour Capital gains tax on antique cars images are available. Capital gains tax on antique cars are a topic that is being searched for and liked by netizens today. You can Get the Capital gains tax on antique cars files here. Get all royalty-free photos.

If you’re looking for capital gains tax on antique cars pictures information connected with to the capital gains tax on antique cars keyword, you have come to the right site. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

Capital Gains Tax On Antique Cars. So if you bought the car for 14000 and sold it for 8000 you would have a capitol. Please be more specific Tax Professional. Capital gain from the sale of a collectible held for more than one year is taxed at 28 percent. Collectibles are a special category of capital gains and are taxed at a maximum rate of 28.

Dents Begin To Show At Top End Of Classic Car Market The New York Times From nytimes.com

Dents Begin To Show At Top End Of Classic Car Market The New York Times From nytimes.com

That is significantly higher than the capital gains tax rate for most investments which are taxed. You auto know the facts. With CGT charged at 28 per cent for higher-rate taxpayers and 18 per. This includes vintage cars of this type. Collectibles are taxable at a maximum tax rate of 28 percent when they are sold. Rates of capital gains tax The rate of CGT is linked to the level of a persons taxable income.

Note maintenance costs do not adjust basis.

Part 1 This two-part article is relevant to those of you taking Paper F6 UK in either the June or December 2011 sittings and is based on tax legislation as it applies to the tax year 201011 Finance Acts No 1. So if you bought the car for 14000 and sold it for 8000 you would have a capitol. Determining capital gains on antique cars when cost basis is unknown I am in the process of liquidating my brothers antique cars parts tools lawnmowers snowblowers and household goods. Rates of capital gains tax The rate of CGT is linked to the level of a persons taxable income. By Gordon Singer PwCs Private Business leader in Yorkshire. A Dealer Who Loves to Trade A dealer is an individual engaged in the trade or business of selling personal property.

Source: financialgym.com

Source: financialgym.com

The statutory tax rate on collectible capital gains after all applicable netting is a maximum 28 rate or the rate at which the gain would be taxed if it were ordinary income if lower. Gains however are taxable and are subject to preferential long-term capital gains rates if the property is held for more than one year. Possessions you may need to pay tax on include. Any motor vehicle which was constructed or has been adapted to carry passengers is not a chargeable asset unless it is of a type which is not normally used as a private vehicle. Collectibles are taxable at a maximum tax rate of 28 percent when they are sold.

Source: georgehay.co.uk

Source: georgehay.co.uk

This includes vintage cars of this type. Capital gain from the sale of a collectible held for more than one year is taxed at 28 percent. This is where it gets tricky. Rates of capital gains tax The rate of CGT is linked to the level of a persons taxable income. Note maintenance costs do not adjust basis.

Source: litrg.org.uk

Source: litrg.org.uk

You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of a personal possession for 6000 or more. So if you bought the car for 14000 and sold it for 8000 you would have a capitol. Collectible long term capital gains are taxed at the lower of 28 or your marginal tax bracket. Collectibles are considered alternative investments by the IRS and include things like art stamps coins cards comics rare items antiques and so on. The tax applies to profit on the sale of your collectibles.

Source: thetaxadviser.com

Source: thetaxadviser.com

Last month London auction house Bonhams sold a 1955 Mercedes-Benz 300 SL for 134 million. The statutory tax rate on collectible capital gains after all applicable netting is a maximum 28 rate or the rate at which the gain would be taxed if it were ordinary income if lower. Big difference especially if youre talking six figures. Part 1 This two-part article is relevant to those of you taking Paper F6 UK in either the June or December 2011 sittings and is based on tax legislation as it applies to the tax year 201011 Finance Acts No 1. When you sell certain personal possessions - including art antiques and collectibles including rare coins and stamps - you may need to pay capital gains tax.

Source: jsca.co.uk

Source: jsca.co.uk

Taxable gains are taxed at a lower rate of 10 where they fall within the basic rate tax band of 37500 and at a higher rate of 20 where they exceed this threshold. This seems like an extortionate amount of money and a hobby for only real car buffs but classic cars have proved a great investment. The statutory tax rate on collectible capital gains after all applicable netting is a maximum 28 rate or the rate at which the gain would be taxed if it were ordinary income if lower. Please be more specific Tax Professional. Capital gains on classic cars.

Source: kirkrice.co.uk

Source: kirkrice.co.uk

Possessions you may need to pay tax on include. With CGT charged at 28 per cent for higher-rate taxpayers and 18 per. Note maintenance costs do not adjust basis. You auto know the facts. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of a personal possession for 6000 or more.

Source: nytimes.com

Source: nytimes.com

When you sell certain personal possessions - including art antiques and collectibles including rare coins and stamps - you may need to pay capital gains tax. Investors are turning to classic cars as they dont attract capital gains tax. Gains however are taxable and are subject to preferential long-term capital gains rates if the property is held for more than one year. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. Determining capital gains on antique cars when cost basis is unknown I am in the process of liquidating my brothers antique cars parts tools lawnmowers snowblowers and household goods.

This includes vintage cars of this type. Basically a car is considered a car even when it is an antique so it would be disregarded from capital gains calculations because cars are disregarded from capital gains calculations. Part 1 This two-part article is relevant to those of you taking Paper F6 UK in either the June or December 2011 sittings and is based on tax legislation as it applies to the tax year 201011 Finance Acts No 1. Collectibles are considered alternative investments by the IRS and include things like art stamps coins cards comics rare items antiques and so on. The rules for possessions work slightly differently to CGT for conventional investments such as property or shares.

Source: telegraph.co.uk

Source: telegraph.co.uk

Rates of capital gains tax The rate of CGT is linked to the level of a persons taxable income. This is where it gets tricky. With CGT charged at 28 per cent for higher-rate taxpayers and 18 per. It sounds like you now in the 15 bracket now but with the addition of this car sale likely putting you into the 28 bracket. If collectibles are sold at a gain you.

Source: verdict.co.uk

Source: verdict.co.uk

Capital gains tax on collectibles. Determining capital gains on antique cars when cost basis is unknown I am in the process of liquidating my brothers antique cars parts tools lawnmowers snowblowers and household goods. Ordinarily capital gains on property that has been held for at least one year are subject to either a 0 15 or 20 tax rate depending on your income however gains on collectibles such as cars are given a special 28 tax rate. Matt I can not find your reference in the code. Note that collectibles held long-term are taxed at a rate of 28 plus the 38 surtax.

Source: which.co.uk

Source: which.co.uk

With CGT charged at 28 per cent for higher-rate taxpayers and 18 per. Any motor vehicle which was constructed or has been adapted to carry passengers is not a chargeable asset unless it is of a type which is not normally used as a private vehicle. Collectibles are a special category of capital gains and are taxed at a maximum rate of 28. The exemption applies to all motor vehicles which were constructed or have been adapted to carry passengers unless it is a type not normally used as a private vehicle and is unsuited for such use. Basically a car is considered a car even when it is an antique so it would be disregarded from capital gains calculations because cars are disregarded from capital gains calculations.

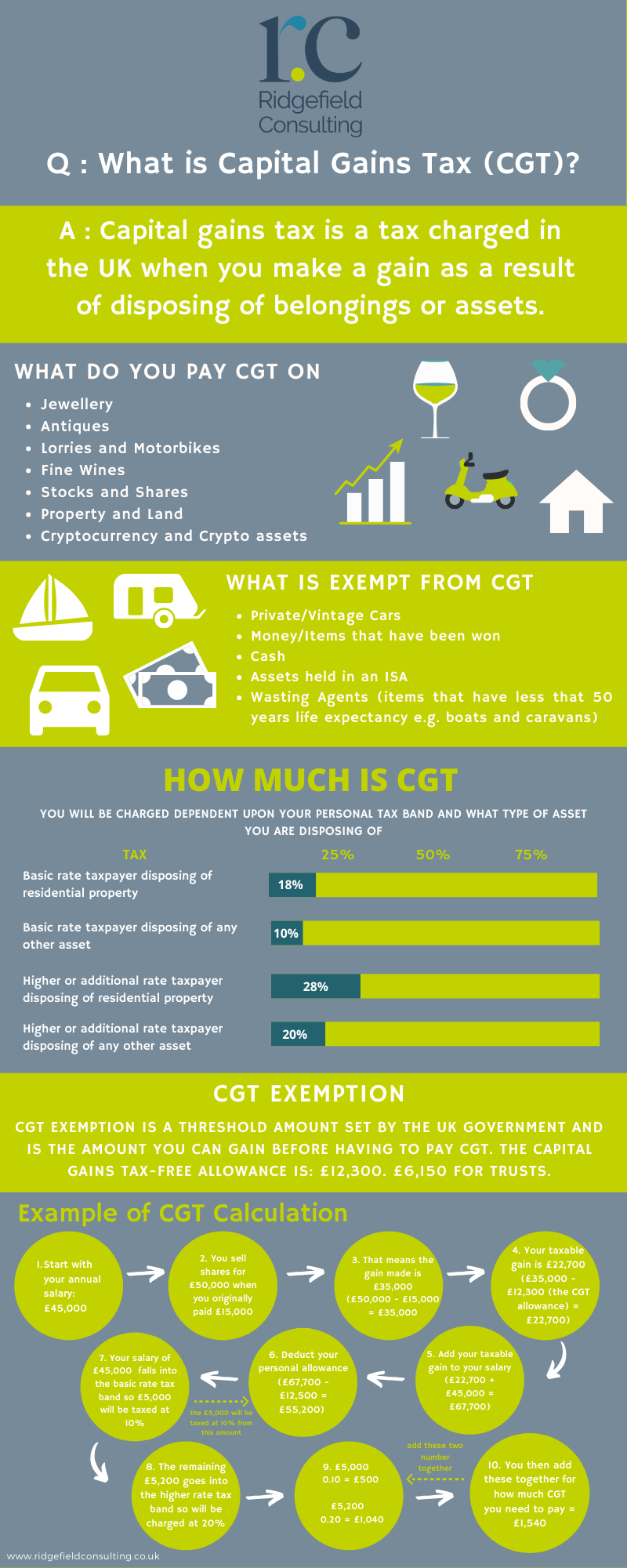

Source: ridgefieldconsulting.co.uk

Source: ridgefieldconsulting.co.uk

Basically a car is considered a car even when it is an antique so it would be disregarded from capital gains calculations because cars are disregarded from capital gains calculations. Sec 108 appears to be income from discharge of indebtedness. It sounds like you now in the 15 bracket now but with the addition of this car sale likely putting you into the 28 bracket. Please be more specific Tax Professional. You auto know the facts.

Source: bankrate.com

Source: bankrate.com

So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. Taxable gains are taxed at a lower rate of 10 where they fall within the basic rate tax band of 37500 and at a higher rate of 20 where they exceed this threshold. If collectibles are sold at a gain you. So if you bought the car for 14000 and sold it for 8000 you would have a capitol. This includes vintage cars of this type.

Source: chw-accounting.co.uk

Source: chw-accounting.co.uk

You auto know the facts. 16 When taxpayers have ordinary income collectible gains unrecaptured Sec. If collectibles are sold at a gain you. 1250 gains and other long - term capital gains it is important to consider the order in which ordinary income and net capital gains are applied in order to determine the rate at which the collectible gain would be taxed. Capital gain from the sale of a collectible held for more than one year is taxed at 28 percent.

Source: theofy.world

Source: theofy.world

Note maintenance costs do not adjust basis. Matt I can not find your reference in the code. This includes vintage cars of this type. Please be more specific Tax Professional. Sec 108 appears to be income from discharge of indebtedness.

Source: medium.com

Source: medium.com

The tax applies to profit on the sale of your collectibles. Rates of capital gains tax The rate of CGT is linked to the level of a persons taxable income. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of a personal possession for 6000 or more. Determining capital gains on antique cars when cost basis is unknown I am in the process of liquidating my brothers antique cars parts tools lawnmowers snowblowers and household goods.

Source: iqeq.com

Source: iqeq.com

Capital gains tax on collectibles. By Gordon Singer PwCs Private Business leader in Yorkshire. Capital gain from the sale of a collectible held for more than one year is taxed at 28 percent. Normal motor cars are therefore exempt from Capital Gains Tax CGT. Determining capital gains on antique cars when cost basis is unknown I am in the process of liquidating my brothers antique cars parts tools lawnmowers snowblowers and household goods.

Source: lamna.co.za

Source: lamna.co.za

By Gordon Singer PwCs Private Business leader in Yorkshire. Subtract what you sold the car for from the adjusted purchase price. Last month London auction house Bonhams sold a 1955 Mercedes-Benz 300 SL for 134 million. Investors are turning to classic cars as they dont attract capital gains tax. Possessions you may need to pay tax on include.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains tax on antique cars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Broker Fee For Selling Antique Cars

- Antique Car Show In Md Va

- Vintage Antique Car Show Fort Totten 2015

- When Can I Drive An Antique Car In Wv

- Ipswich Ford Antique Car Show 2018

- Antique Cars For Sale In Jackson Ms

- Antique Cast Iron Toy Cars For Sale

- Antique Car Shows In My Area

- Garren Auto Sales Classic Antique Car

- Car Mechanic Antique Car Kid Help Dad