Federal Taxes On Sale Of Antique Car

Home » Apartment » Federal Taxes On Sale Of Antique CarYour Federal taxes on sale of antique car images are ready in this website. Federal taxes on sale of antique car are a topic that is being searched for and liked by netizens now. You can Get the Federal taxes on sale of antique car files here. Get all free vectors.

If you’re searching for federal taxes on sale of antique car pictures information linked to the federal taxes on sale of antique car topic, you have pay a visit to the right site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Federal Taxes On Sale Of Antique Car. It also depends on your salary. If for example you sold a vintage automobile online for a profit you should report this gain. The deduction is based on the portion of mileage used for business. Duty and Taxes in US or equivalent amount in Pak.

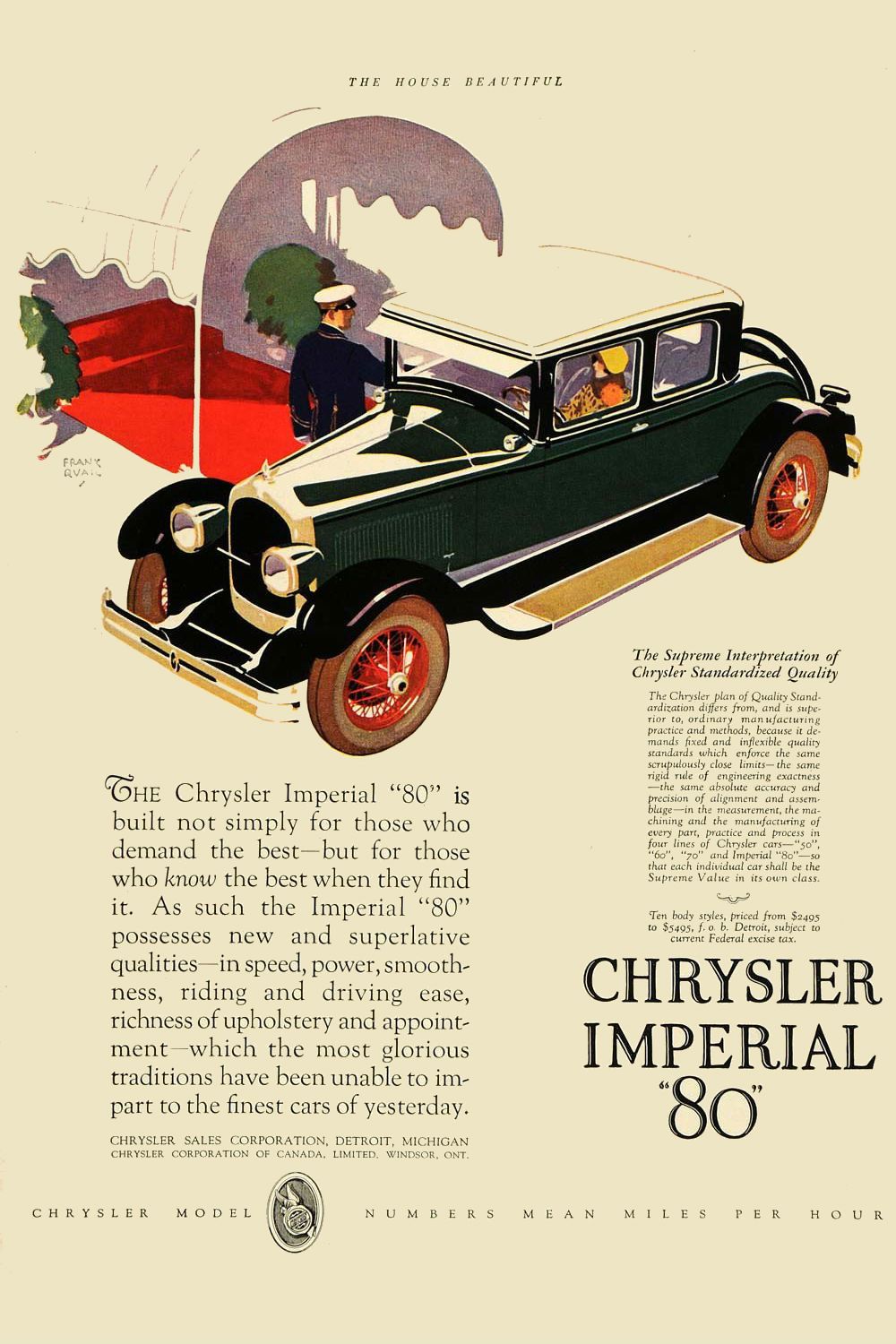

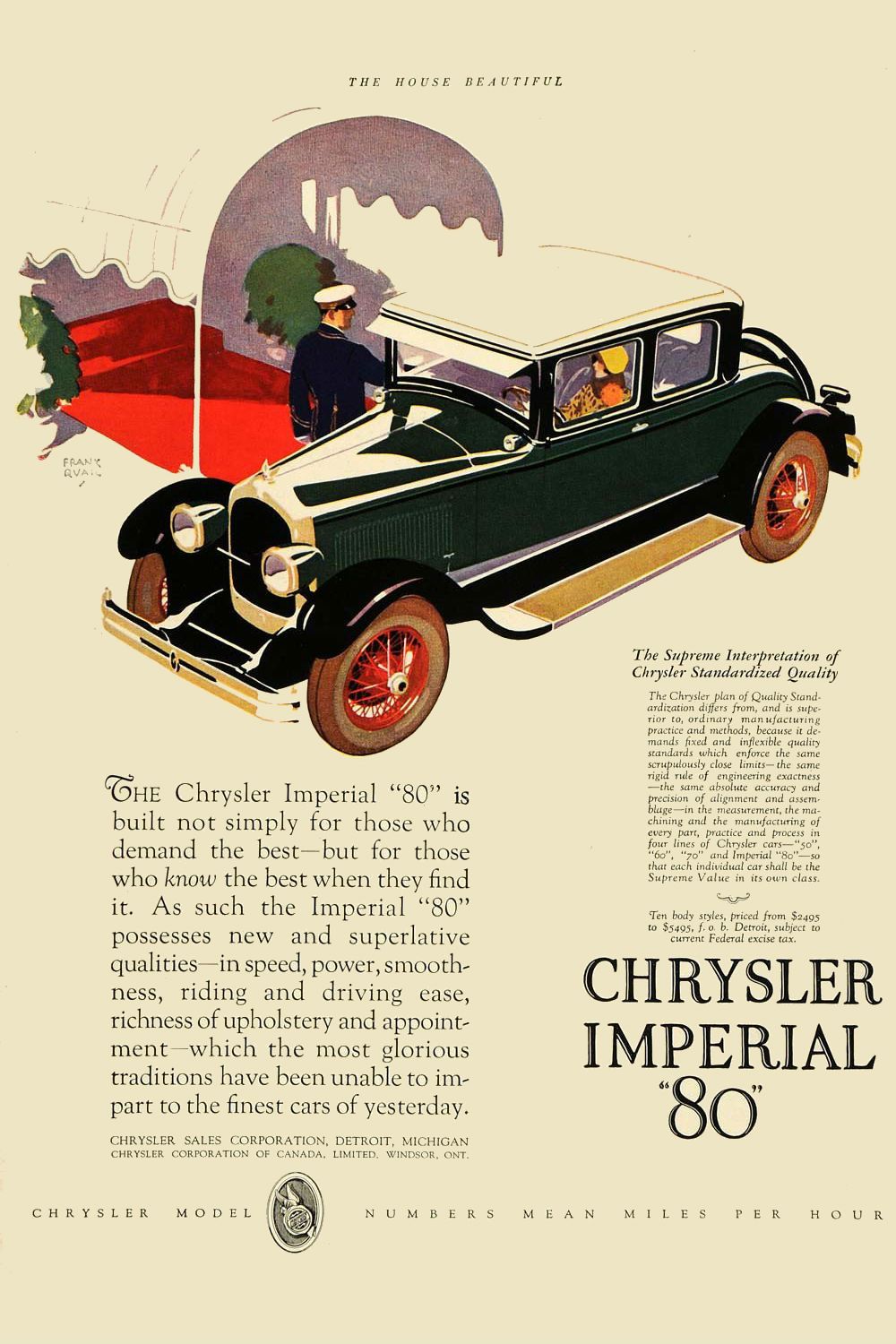

Most Popular Car The Year You Were Born History Of Cars From popularmechanics.com

Most Popular Car The Year You Were Born History Of Cars From popularmechanics.com

A recipient owes income tax only if a car is given in exchange for. Normally the IRS long-term capital gains tax rates on investable assets are either 0 15 or 20 depending on your taxable income and filing status. For example if your car has an adjusted basis of 5000 and you sell the car for 6000 you have a gain of 1000. Selling one yourself will net you more money than what youd get for a trade-inbut buying or selling from a dealership also has its conveniences such as getting help in figuring out any necessary. Classic car buyers should be wary of paying appropriate taxes. A Queens man was left to choose between admitting to tax fraud or insurance fraud after obtaining an agreed value collector car.

Youll have to dump the stock before you can claim it.

If for example you sold a vintage automobile online for a profit you should report this gain. A recipient owes income tax only if a car is given in exchange for. Vehicles of Asian Makes meant for transportation of persons. Youll have to dump the stock before you can claim it. July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks. Since you stated you made over 40k on the car alone youre likely paying 15 on it if you owned it for at least a year.

Source: kirkrice.co.uk

Source: kirkrice.co.uk

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Buying a car from a private seller will usually result in a lower price tag. For example if your car has an adjusted basis of 5000 and you sell the car for 6000 you have a gain of 1000. July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return.

Source: popularmechanics.com

Source: popularmechanics.com

It also depends on your salary. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. Yes you can sell the car and keep the proceeds even though the IRS has filed a tax lien against you. July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks. The HST is a Federal Tax so the rules about them are Canada wide.

Source: thebalance.com

Source: thebalance.com

For the used cars the calculations are different. The HST is a Federal Tax so the rules about them are Canada wide. Capital Gain Tax Rates. Federal income tax implications According to the IRS Topic 409 collectibles are considered for tax purposes as a capital asset and depending on how long you hold them before selling will determines the tax rate. However tangible property held for investment purposes including antiques qualifies for.

Source: thenewswheel.com

Source: thenewswheel.com

Big difference especially if youre talking six figures. If for example you sold a vintage automobile online for a profit you should report this gain. Capital Gain Tax Rates. Big difference especially if youre talking six figures. The HST is a Federal Tax so the rules about them are Canada wide.

Source: creditkarma.com

Source: creditkarma.com

Youll have to dump the stock before you can claim it. Collectibles are a special category of capital gains and are taxed at a maximum rate of 28. Vehicles of Asian Makes meant for transportation of persons. The deduction is based on the portion of mileage used for business. Business owners and self-employed individuals.

Source: marottaonmoney.com

Source: marottaonmoney.com

Classic car buyers should be wary of paying appropriate taxes. The deduction is based on the portion of mileage used for business. This 4 sales tax is based on the total price. If your total costs are less than what you sold it for you would have a personal capital gain and you would need to report it on your tax return in the year of sale. Recipients dont owe taxes for accepting gifts.

Source: thenevadaindependent.com

Source: thenevadaindependent.com

Reportable gains on online sales of items such as antiques art and collectibles should be reported to the IRS where the sales price is more than the cost of the item. For the used cars the calculations are different. Normally the IRS long-term capital gains tax rates on investable assets are either 0 15 or 20 depending on your taxable income and filing status. If your losses exceed 3000 you can carry the losses forward to the next tax year. Reportable gains on online sales of items such as antiques art and collectibles should be reported to the IRS where the sales price is more than the cost of the item.

Source: seattletimes.com

Source: seattletimes.com

Classic car buyers should be wary of paying appropriate taxes. The tax rate on most net capital gain is no higher than 15 for most individuals. When you sell your car only the portion of the selling price that exceeds the adjusted basis of the car is taxable gain. Since you stated you made over 40k on the car alone youre likely paying 15 on it if you owned it for at least a year. The deduction is based on the portion of mileage used for business.

Source: nl.pinterest.com

Source: nl.pinterest.com

You can claim up to 3000 in losses on your tax return. In other words unless your buyer knows about the Federal tax lien when he buys the car the tax lien does not have to be paid to permit transfer and sale. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. The HST is a Federal Tax so the rules about them are Canada wide. July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks.

Source: pinterest.cl

Source: pinterest.cl

Selling one yourself will net you more money than what youd get for a trade-inbut buying or selling from a dealership also has its conveniences such as getting help in figuring out any necessary. Normally the IRS long-term capital gains tax rates on investable assets are either 0 15 or 20 depending on your taxable income and filing status. In other words unless your buyer knows about the Federal tax lien when he buys the car the tax lien does not have to be paid to permit transfer and sale. Yes you can sell the car and keep the proceeds even though the IRS has filed a tax lien against you. If your losses exceed 3000 you can carry the losses forward to the next tax year.

Source: statefarm.com

Source: statefarm.com

This 4 sales tax is based on the total price. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. If your total costs are less than what you sold it for you would have a personal capital gain and you would need to report it on your tax return in the year of sale. Generally the IRS levies a 28 percent tax on gains from the sale of collectibles except when theyre inventory in a business or trade in which case the IRS treats these gains as income. Selling one yourself will net you more money than what youd get for a trade-inbut buying or selling from a dealership also has its conveniences such as getting help in figuring out any necessary.

Source: taxesforexpats.com

Source: taxesforexpats.com

Reportable gains on online sales of items such as antiques art and collectibles should be reported to the IRS where the sales price is more than the cost of the item. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. If a taxpayer uses the car for both business and personal purposes the expenses must be split. You can claim up to 3000 in losses on your tax return. If your total costs are less than what you sold it for you would have a personal capital gain and you would need to report it on your tax return in the year of sale.

Source: bankrate.com

Source: bankrate.com

Federal income tax implications According to the IRS Topic 409 collectibles are considered for tax purposes as a capital asset and depending on how long you hold them before selling will determines the tax rate. Capital Gain Tax Rates. However tangible property held for investment purposes including antiques qualifies for. The rate is set at 13 of what is showing on the sale invoice. If your losses exceed 3000 you can carry the losses forward to the next tax year.

Source: moneysavingexpert.com

Source: moneysavingexpert.com

A Queens man was left to choose between admitting to tax fraud or insurance fraud after obtaining an agreed value collector car. July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks. For example if your car has an adjusted basis of 5000 and you sell the car for 6000 you have a gain of 1000. The tax rate on most net capital gain is no higher than 15 for most individuals. It also depends on your salary.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

For the used cars the calculations are different. If for example you sold a vintage automobile online for a profit you should report this gain. Youll have to dump the stock before you can claim it. Check Internal Revenue Service for current rates but in 2008 if you made 32550 including the sale of the car or less you pay 0 on long term capital gains. So if your cost for the car plus the cost of any improvements is more than you sold it for then you have a personal capital loss and that is not reportable or deductible on your tax return.

Source: friendandgrant.co.uk

Source: friendandgrant.co.uk

Generally the IRS levies a 28 percent tax on gains from the sale of collectibles except when theyre inventory in a business or trade in which case the IRS treats these gains as income. Depending on the nature of the online sale the gain may be reported as business. A capital gain rate of 15 applies if your taxable income is 80000 or more but less than 441450 for single. If a taxpayer uses the car for both business and personal purposes the expenses must be split. Classic car buyers should be wary of paying appropriate taxes.

Source: motherjones.com

Source: motherjones.com

July 21 2021 When it comes to buying and selling a car cutting out the middleman has plenty of perks. Since you stated you made over 40k on the car alone youre likely paying 15 on it if you owned it for at least a year. Youll have to dump the stock before you can claim it. You can claim up to 3000 in losses on your tax return. A capital gain rate of 15 applies if your taxable income is 80000 or more but less than 441450 for single.

Source: carbuyer.co.uk

Source: carbuyer.co.uk

You can claim up to 3000 in losses on your tax return. Generally the IRS levies a 28 percent tax on gains from the sale of collectibles except when theyre inventory in a business or trade in which case the IRS treats these gains as income. A recipient owes income tax only if a car is given in exchange for. So in most cases any gain when selling an old car will be a long-term capital gain held more than one year and is presently taxed at a maximum rate of 15. Paying the HST on a new car is straightforward when it comes to Ontario.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title federal taxes on sale of antique car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Broker Fee For Selling Antique Cars

- Antique Car Show In Md Va

- Vintage Antique Car Show Fort Totten 2015

- When Can I Drive An Antique Car In Wv

- Ipswich Ford Antique Car Show 2018

- Antique Cars For Sale In Jackson Ms

- Antique Cast Iron Toy Cars For Sale

- Antique Car Shows In My Area

- Garren Auto Sales Classic Antique Car

- Car Mechanic Antique Car Kid Help Dad