How Much Is Sales Tax In Arkansas On Antique Cars

Home » Best apartment » How Much Is Sales Tax In Arkansas On Antique CarsYour How much is sales tax in arkansas on antique cars images are available in this site. How much is sales tax in arkansas on antique cars are a topic that is being searched for and liked by netizens today. You can Get the How much is sales tax in arkansas on antique cars files here. Download all free vectors.

If you’re looking for how much is sales tax in arkansas on antique cars images information related to the how much is sales tax in arkansas on antique cars interest, you have come to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

How Much Is Sales Tax In Arkansas On Antique Cars. Click here for a larger sales tax map or here for a sales tax table. Act 368 changes the states current laws concerning antique cars. Effective July 1 2013. The total sales tax rate is controlled by the following 3 entities and their individual sales tax rates.

This holds true for private car sales or vehicles purchased from car dealers in Arkansas. You can register it normally and pay a normal registration fee. Arkansas collects a 65 state sales tax rate on the purchase of all vehicles which cost more than 4000 dollars. A list of tax rates for cities and counties may be obtained from the Sales Tax and Use Tax Section or downloaded from our website. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Replacement registrations may be obtained for a fee of 100.

Tax exemption for classic cars is now rolling.

This holds true for private car sales or vehicles purchased from car dealers in Arkansas. LITTLE ROCK KFSM A new bill in Arkansas aims to redefine what the state considers an antique car. The percentage of sales tax charged is generally 6 percent of the total sales price. This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax. Vehicles which were purchased at a cost of 4000 dollars or less are not applicable for state sales tax and will not be charged. In addition to the saving on VED since 2018 nearly all cars built more than 40 years ago are.

Source: swtimes.com

Source: swtimes.com

For historical or special interest vehicles or any vehicle that is forty five 45 years old or older which is essentially unaltered from the. This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax. Act 368 changes the states current laws concerning antique cars. The total sales tax rate is controlled by the following 3 entities and their individual sales tax rates. A list of tax rates for cities and counties may be obtained from the Sales Tax and Use Tax Section or downloaded from our website.

Source: stlucieappraisal.net

Source: stlucieappraisal.net

Or you can register it as an Antique for 10 per year with the exhibitions and. For historical or special interest vehicles or any vehicle that is forty five 45 years old or older which is essentially unaltered from the. Arkansas Sales Tax Calculator. In addition you are required to remit the city andor county tax where the items are first delivered in Arkansas. By Staff Writer Last Updated April 7 2020 Multiply the purchase price of the used vehicle by the Arkansas sales tax rate of 65 percent to determine the sales tax you need to pay when you buy a used car in Arkansas.

Source: issuu.com

Source: issuu.com

Sales Tax Credit for Sale of a Used Vehicle Act 1232 of 1997 as amended by Act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles trailers or semitrailers purchased on or after July 28 2021 if within 60 days either before or after the date of purchase the consumer sells a used motor vehicle trailer or semitrailer. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. New Arkansas Law Redefines Classic Cars From 25 to 45 Years Old to Snub All Your Radwood Rides Cars less than 45 years old no longer qualify for the states 7 antique vehicle tags in. There are also local taxes up to 1 which will vary depending on region. Check Your Car Title Status Once youve registered your vehicle for a title you can look up the status of your title application here.

The percentage of sales tax charged is generally 6 percent of the total sales price. Effective July 1 2013. In addition you are required to remit the city andor county tax where the items are first delivered in Arkansas. The law setting the 500 property tax assessment limit on antique vehicles was enacted in 1973 PA 73-531. Arkansas does not charge sales tax on casual sales individual to individual for boats.

Source: findthebestcarprice.com

Source: findthebestcarprice.com

You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address zip code. The state Use Tax rate is the same as the Sales Tax rate 6500. Tax exemption for classic cars is now rolling. The certificate of number pocket sized registration card must be onboard and available for inspection by an enforcement officer whenever the. The original law allowed the special tax treatment only for vehicles for which DMV had issued antique vehicle license plates.

Source: hemmings.com

Source: hemmings.com

Arkansas Sales Tax Calculator. Replacement registrations may be obtained for a fee of 100. For historical or special interest vehicles or any vehicle that is forty five 45 years old or older which is essentially unaltered from the. The original law allowed the special tax treatment only for vehicles for which DMV had issued antique vehicle license plates. The percentage of sales tax charged is generally 6 percent of the total sales price.

Source: caranddriver.com

Source: caranddriver.com

Sales Tax Credit for Sale of a Used Vehicle Act 1232 of 1997 as amended by Act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles trailers or semitrailers purchased on or after July 28 2021 if within 60 days either before or after the date of purchase the consumer sells a used motor vehicle trailer or semitrailer. Specialty license plate for antique 45 years or older vehicle. However if the total sales price of the vehicles is less than 2500 no sales tax will be charged. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. In addition to the saving on VED since 2018 nearly all cars built more than 40 years ago are.

Source: factorywarrantylist.com

Source: factorywarrantylist.com

In addition you are required to remit the city andor county tax where the items are first delivered in Arkansas. Vehicles which were purchased at a cost of 4000 dollars or less are not applicable for state sales tax and will not be charged. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55. There are also local taxes up to 1 which will vary depending on region. By Staff Writer Last Updated April 7 2020 Multiply the purchase price of the used vehicle by the Arkansas sales tax rate of 65 percent to determine the sales tax you need to pay when you buy a used car in Arkansas.

Source: findthebestcarprice.com

Source: findthebestcarprice.com

Specialty license plate for antique 45 years or older vehicle. City of Fayetteville - 200 Washington County - 125 State of Arkansas - 650. There are a total of 268 local tax jurisdictions across the state collecting an average local tax of 2126. In addition to the saving on VED since 2018 nearly all cars built more than 40 years ago are. Act 368 changes the states current laws concerning antique cars.

Source: gobankingrates.com

Source: gobankingrates.com

Or you can register it as an Antique for 10 per year with the exhibitions and. Arkansas collects a 65 state sales tax rate on the purchase of all vehicles which cost more than 4000 dollars. Replacement registrations may be obtained for a fee of 100. Click here for a larger sales tax map or here for a sales tax table. LITTLE ROCK KFSM A new bill in Arkansas aims to redefine what the state considers an antique car.

LITTLE ROCK KFSM A new bill in Arkansas aims to redefine what the state considers an antique car. This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax. Act 368 changes the states current laws concerning antique cars. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55. You can register it as a Classic which is for cars 25 years old or older for 40 per year with no driving restrictions.

Source: arkansasonline.com

Source: arkansasonline.com

This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax. Check Your Car Title Status Once youve registered your vehicle for a title you can look up the status of your title application here. Arkansas does not charge sales tax on casual sales individual to individual for boats. Vehicles which were purchased at a cost of 4000 dollars or less are not applicable for state sales tax and will not be charged. You can register it as a Classic which is for cars 25 years old or older for 40 per year with no driving restrictions.

Source: baxterbulletin.com

Source: baxterbulletin.com

New Arkansas Law Redefines Classic Cars From 25 to 45 Years Old to Snub All Your Radwood Rides Cars less than 45 years old no longer qualify for the states 7 antique vehicle tags in. You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address zip code. Arkansas does not charge sales tax on casual sales individual to individual for boats. There are a total of 268 local tax jurisdictions across the state collecting an average local tax of 2126. The original law allowed the special tax treatment only for vehicles for which DMV had issued antique vehicle license plates.

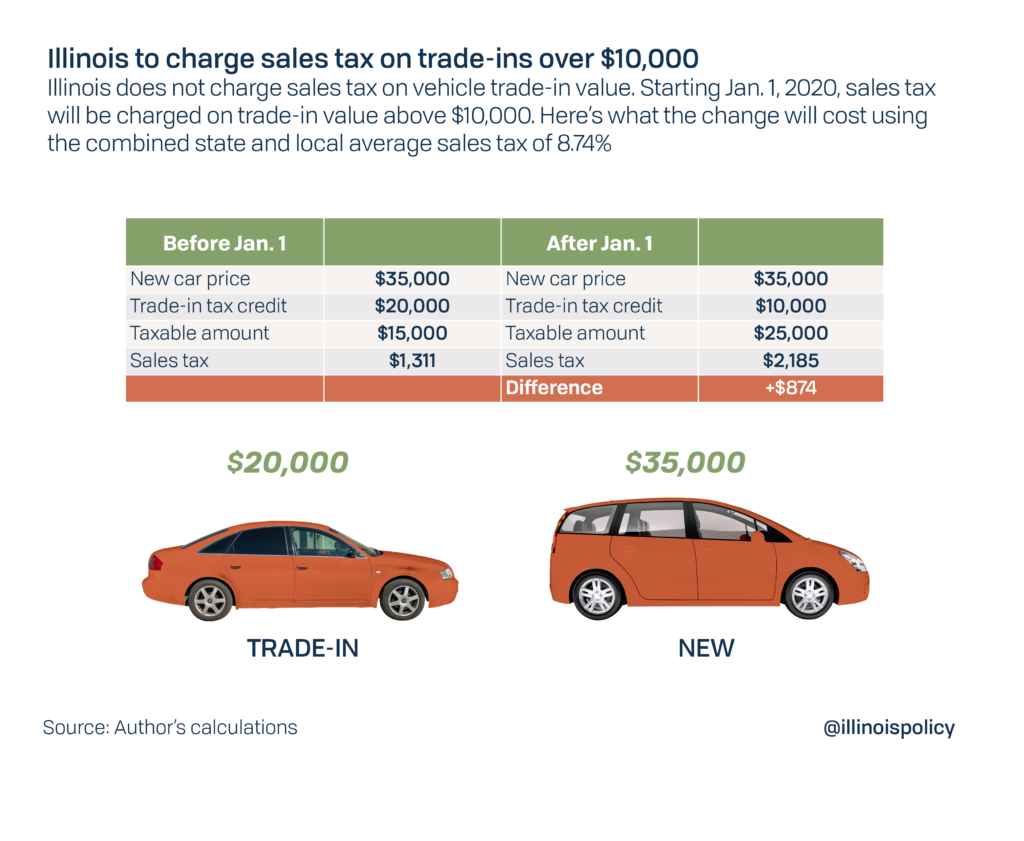

Source: illinoispolicy.org

Source: illinoispolicy.org

In addition to the saving on VED since 2018 nearly all cars built more than 40 years ago are. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. City of Fayetteville - 200 Washington County - 125 State of Arkansas - 650.

You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address zip code. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. In addition you are required to remit the city andor county tax where the items are first delivered in Arkansas. A list of tax rates for cities and counties may be obtained from the Sales Tax and Use Tax Section or downloaded from our website. Replacement registrations may be obtained for a fee of 100.

Source: news.stlpublicradio.org

Source: news.stlpublicradio.org

There are a total of 268 local tax jurisdictions across the state collecting an average local tax of 2126. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. City of Fayetteville - 200 Washington County - 125 State of Arkansas - 650. Or you can register it as an Antique for 10 per year with the exhibitions and.

Click here for a larger sales tax map or here for a sales tax table. A list of tax rates for cities and counties may be obtained from the Sales Tax and Use Tax Section or downloaded from our website. Those who buy a vehicle in Texarkana are required to pay 7 percent sales tax. Arkansas has a 65 statewide sales tax rate but also has 268. There are also local taxes up to 1 which will vary depending on region.

Source: integratedendpoints.com

Source: integratedendpoints.com

Arkansas has a 65 statewide sales tax rate but also has 268. The percentage of sales tax charged is generally 6 percent of the total sales price. For historical or special interest vehicles or any vehicle that is forty five 45 years old or older which is essentially unaltered from the. Antique Vehicle License Plate - Current. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is sales tax in arkansas on antique cars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Antique Car For Rent In Malaysia

- Dover Nj Antique Cars Fire 1970s

- Big Bear Antique Car Club Fun Run

- Antique Brass Era Cars For Sale

- Patricks Antique Cars Trucks Casa Grande Az

- California Dmv Antique Car Registration Non Operational

- When Does A Car Become An Antique In Virginia

- Westchester Couare Brass Headlight For Antique Car

- Antique Cars For Sale In Las Vegas

- Best Antique Car To Buy For Value