Illinois Sales Tax On Antique Cars

Home » Apartment » Illinois Sales Tax On Antique CarsYour Illinois sales tax on antique cars images are ready. Illinois sales tax on antique cars are a topic that is being searched for and liked by netizens today. You can Download the Illinois sales tax on antique cars files here. Find and Download all royalty-free images.

If you’re looking for illinois sales tax on antique cars pictures information linked to the illinois sales tax on antique cars interest, you have pay a visit to the right blog. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

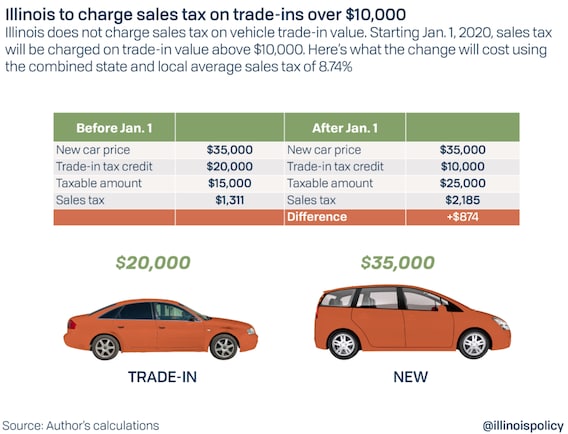

Illinois Sales Tax On Antique Cars. Illinois tax on new and used vehicles is generally 625. 1 Illinois sales tax applies to any trade-in. There is also between a 025 and 075 when it comes to county tax. Fees Random-Number Antique License Plates - Dec.

The Best Auto Museums Near Chicago Il Elgin Vw From elginvw.com

The Best Auto Museums Near Chicago Il Elgin Vw From elginvw.com

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Dealers call it double taxation The state collects no sales tax on trade-in value but that changes next year. Illinois imposing car trade-in tax on Jan. The vehicle use tax must be paid within 30 days and must be paid when you apply for a title or registration. TurboTax Premier Online 0 1 3362 Reply 1 Reply RyanH2 New Member June 6 2019. Purchasing a Used Car From a Private Party in Illinois.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Under the new law only the first 10000 in trade-in value can be. Two states have car sales tax rates below 5. Fees Random-Number Antique License Plates - Dec. Arkansas Colorado Arizona Illinois. 31 2020 expiration 2020 - 30 2021 - 24 2022 - 18 2023 - 12 2024 - 6 Current non-antique plates expire within 1 year - 59 30 Antique Vehicle license plates fee 29. 2021 Illinois state sales tax.

Source: news.stlpublicradio.org

Source: news.stlpublicradio.org

Tax will then be due on THAT amount PLUS penalties. Can I deduct sales tax paid in Illinois on a vehicle purchased from a dealer Topics. Illinois imposing car trade-in tax on Jan. Exact tax amount may vary for different items. Prior to 2020 Illinois did not collect a sales tax on a cars trade-in value unless the vehicle was worth more than 20000.

Source: pinterest.cl

Source: pinterest.cl

A bipartisan group of Illinois lawmakers has gotten behind a proposal to repeal the states new car trade-in tax and replace it with a different fee structure. Municipal governments in Illinois are also allowed to collect a local-option sales tax that ranges from 0 to 475 across the state with an average local tax of 1571 for a total of 7821 when combined with the state sales tax. The maximum local tax rate allowed by Illinois law is 4. North Carolina and Hawaii at 3 and 45 respectively. Actual tax rates throughout the state vary because in addition to.

Source: pinterest.fr

Source: pinterest.fr

Illinois Sales Tax on Car Purchases According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000. It used to be 150000 or less or over 10 years old then it was just a flat 2500 tax if the price of the vehicle was more than 150000 or its newer than 10 years old then the Illinois sales tax kicked in. 1 Illinois sales tax applies to any trade-in. The vehicle use tax is the same rate as the sales tax.

Source: antiques.lovetoknow.com

Source: antiques.lovetoknow.com

Car dealers call the 60 million to be. Purchasing a Used Car From a Private Party in Illinois. The cost to obtain extended-use antique car tags and registration on. Under the new law only the first 10000 in trade-in value can be. Municipal governments in Illinois are also allowed to collect a local-option sales tax that ranges from 0 to 475 across the state with an average local tax of 1571 for a total of 7821 when combined with the state sales tax.

Source: hemmings.com

Source: hemmings.com

Ordinarily your tax liability would be 3000 on a purchase like that. Illinois has a statewide sales tax rate of 625 which has been in place since 1933. 1 Illinois sales tax applies to any trade-in. The cost to obtain extended-use antique car tags and registration on. Arkansas Colorado Arizona Illinois.

Source: elginvw.com

Source: elginvw.com

Illinois tax on new and used vehicles is generally 625. The vehicle use tax must be paid within 30 days and must be paid when you apply for a title or registration. Clair and Madison counties have different sales tax rates. Illinois imposing car trade-in tax on Jan. Ordinarily your tax liability would be 3000 on a purchase like that.

Source: dmvconnect.com

Source: dmvconnect.com

The statewide sales tax rate is 625 collected by the Illinois Department of Revenue with 125 being returned to local governments where the goods were purchased. If you are leasing the vehicle from an out-of-state retailer you must use Form RUT-25-LSE to report the transaction. Clair and Madison counties have different sales tax rates. Bipartisan push would repeal Illinois car trade-in tax. Municipal governments in Illinois are also allowed to collect a local-option sales tax that ranges from 0 to 475 across the state with an average local tax of 1571 for a total of 7821 when combined with the state sales tax.

Source: statefarm.com

Source: statefarm.com

Exact tax amount may vary for different items. Illinois imposing car trade-in tax on Jan. Illinois has a statewide sales tax rate of 625 which has been in place since 1933. Illinois has 1018 special sales tax. If youre buying a new or used car its important to know the taxes and fees you may have to pay.

Source: carsforsale.com

Source: carsforsale.com

The Illinois state sales tax rate is 625 and the average IL sales tax after local surtaxes is 819. Illinois imposing car trade-in tax on Jan. Illinois tax on new and used vehicles is generally 625. However on the opposite end is Oklahoma which has the highest car sales tax at 1150 followed by Louisiana with 1145. Purchasing a Used Car From a Private Party in Illinois.

Source: sellmycarinchicagowithenriqueforcash.com

Source: sellmycarinchicagowithenriqueforcash.com

North Carolina and Hawaii at 3 and 45 respectively. You should attach a copy of the bill of sale as proof of the purchase price. Counties and cities can charge an additional local sales tax of up to 35 for a maximum possible combined sales tax of 975. Car dealers call the 60 million to be. Illinois has 1018 special sales tax.

Source: dailyherald.com

Source: dailyherald.com

Sales tax on a vintage car is a flat 125 fee plus 25 in a one-time tax regardless of how much you paid for the car. Ordinarily your tax liability would be 3000 on a purchase like that. Actual tax rates throughout the state vary because in addition to. You should attach a copy of the bill of sale as proof of the purchase price. Tax will then be due on THAT amount PLUS penalties.

Source: carsforsale.com

Source: carsforsale.com

Under the new law only the first 10000 in trade-in value can be. You should attach a copy of the bill of sale as proof of the purchase price. A bipartisan group of Illinois lawmakers has gotten behind a proposal to repeal the states new car trade-in tax and replace it with a different fee structure. Illinois has 1018 special sales tax. The original law allowed the special tax treatment only for vehicles for which DMV had issued antique vehicle license plates.

Source: vwofchicagoland.com

Source: vwofchicagoland.com

The maximum local tax rate allowed by Illinois law is 4. The Illinois state sales tax rate is 625 and the average IL sales tax after local surtaxes is 819. For example applying for a custom vehicle registration in IL is a procedure that currently includes a 196 fee for the registration card and the vehicle title as well as additional sales tax costs. This page covers the most important aspects of Illinois sales tax with respects to vehicle purchases. The total payable amount for custom or antique auto registrations will vary based on several factors and it will include different types of costs.

Source: ednapletonhonda.com

Source: ednapletonhonda.com

2021 Illinois state sales tax. However on the opposite end is Oklahoma which has the highest car sales tax at 1150 followed by Louisiana with 1145. Clair and Madison counties have different sales tax rates. Bipartisan push would repeal Illinois car trade-in tax. This 2500 flat tax was designed around your everyday car or truck.

Source: caranddriver.com

Source: caranddriver.com

A bipartisan group of Illinois lawmakers has gotten behind a proposal to repeal the states new car trade-in tax and replace it with a different fee structure. This 2500 flat tax was designed around your everyday car or truck. Two states have car sales tax rates below 5. Purchasing a Used Car From a Private Party in Illinois. For vehicles that are being rented or leased see see taxation of leases and rentals.

Source: caranddriver.com

Source: caranddriver.com

The total payable amount for custom or antique auto registrations will vary based on several factors and it will include different types of costs. It originally wasnt thought about for classic cars but now that classic cars are the. Two states have car sales tax rates below 5. Clair and Madison counties have different sales tax rates. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000.

Source: en.wikipedia.org

Source: en.wikipedia.org

Two states have car sales tax rates below 5. See Form RUT-25 for the appropriate rate if the address for the title or registration is in one of these counties. Dealers call it double taxation The state collects no sales tax on trade-in value but that changes next year. Under the new law only the first 10000 in trade-in value can be. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the vehicle into Illinois.

Source: sellmycarinchicagowithenriqueforcash.com

Source: sellmycarinchicagowithenriqueforcash.com

Illinois tax on new and used vehicles is generally 625. Fees Random-Number Antique License Plates - Dec. Illinois has a statewide sales tax rate of 625 which has been in place since 1933. Actual tax rates throughout the state vary because in addition to. North Carolina and Hawaii at 3 and 45 respectively.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title illinois sales tax on antique cars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Broker Fee For Selling Antique Cars

- Antique Car Show In Md Va

- Vintage Antique Car Show Fort Totten 2015

- When Can I Drive An Antique Car In Wv

- Ipswich Ford Antique Car Show 2018

- Antique Cars For Sale In Jackson Ms

- Antique Cast Iron Toy Cars For Sale

- Antique Car Shows In My Area

- Garren Auto Sales Classic Antique Car

- Car Mechanic Antique Car Kid Help Dad