Personal Property Tax On Antique Car Va

Home » Apartment » Personal Property Tax On Antique Car VaYour Personal property tax on antique car va images are available. Personal property tax on antique car va are a topic that is being searched for and liked by netizens today. You can Find and Download the Personal property tax on antique car va files here. Get all royalty-free photos and vectors.

If you’re looking for personal property tax on antique car va images information related to the personal property tax on antique car va keyword, you have visit the ideal site. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Personal Property Tax On Antique Car Va. This will depend upon the value of the car at the first of the year. Virginia taxes your automobiles every year as a property tax. Calculating Personal Property Tax Example of a personal use vehicle with an assessed value of 20000 or less. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

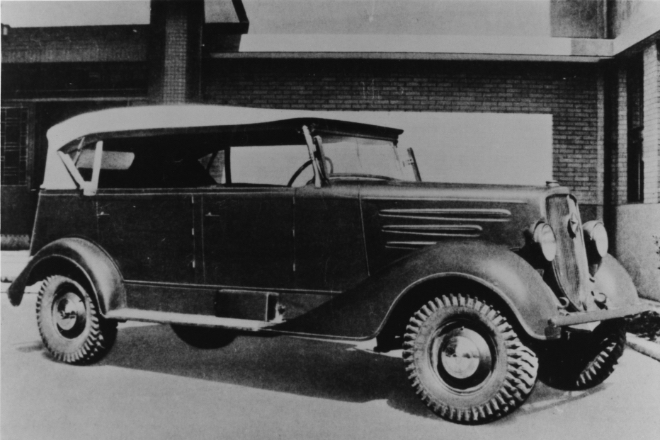

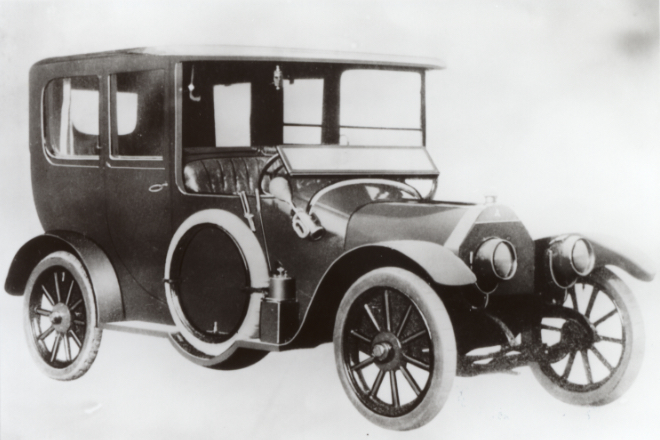

Multiple States Look To Amend License Plate Laws For Historic Vehicles Hemmings From hemmings.com

Multiple States Look To Amend License Plate Laws For Historic Vehicles Hemmings From hemmings.com

Assessed value of 19300 19300 x 036 69480 for 12 months Calculate personal property relief. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. But why does Virginia have an annual car tax that. Compliance Division Enforcement Program. The bills are due each year on Oct. For properties included in a special subclass the tax rate is 001 per 100 of assessed value.

However if you place regular plates on an antique legally you have to do so for a daily driver although some people ignore this they may place a value on it.

The vehicle personal property tax is a prorated tax but the 100 license tax is not. Personal Property Registration Form An ANNUAL. My personal property taxes on two such licensed cars in 2014 was 175 for 69 Cutlass convertible and. Tax bills are reduced by Virginia Beachs expected reimbursement under the Personal Property Tax Relief Act from the Commonwealth for qualified vehicles based on the first 20000 of value. Personal use vehicles may be eligible for the Personal Property Tax Relief Act PPTRA. This will be a continuous tax to figure in your costs.

Source: hemmings.com

Source: hemmings.com

For properties included in a special subclass the tax rate is 001 per 100 of assessed value. Vehicles are assessed at fair market value. Motor Vehicle Personal Property Tax Proration Every person or business owning a motor vehicle automobile truck bus motorcycle trailer semitrailer van recreational vehicle moped etc is required to file a personal property tax return. 5 or the following business day if Oct. But why does Virginia have an annual car tax that.

Source: hemmings.com

Source: hemmings.com

Vehicles must be registered with the Fairfax County Department of Tax Administration DTA within 60 days of purchase or move-in to the county and are subject to the vehicle Tax. For properties included in a special subclass the tax rate is 001 per 100 of assessed value. Chesapeake prorates personal property taxes on motor vehicles. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. Report a Tax Evader.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Section 581-3527 of the Personal Property Tax Relief Act stipulates that the Comptroller shall prescribe the form of reimbursement request for tax years 1999 and thereafter. You may use the following points in your message. Most recent tax relief rates are as follows. When do I need to register my vehicle with Fairfax County. However if you place regular plates on an antique legally you have to do so for a daily driver although some people ignore this they may place a value on it.

Source: fcva.us

5 falls on a weekend or holiday. Tax bills are reduced by Virginia Beachs expected reimbursement under the Personal Property Tax Relief Act from the Commonwealth for qualified vehicles based on the first 20000 of value. Vehicles are assessed at fair market value. However if you place regular plates on an antique legally you have to do so for a daily driver although some people ignore this they may place a value on it. For automobiles the NADA official used car pricing guide is used in most cases.

Source: marottaonmoney.com

Source: marottaonmoney.com

Vehicle Personal Property Tax The tax rate for most vehicles is 457 per 100 of assessed value. A higher-valued property pays more tax than a lower-valued property. Personal Property Taxes are billed once a year with a December 5 th due date. 5 falls on a weekend or holiday. Compliance Division Enforcement Program.

Source: caranddriver.com

Source: caranddriver.com

Section 581-3527 of the Personal Property Tax Relief Act stipulates that the Comptroller shall prescribe the form of reimbursement request for tax years 1999 and thereafter. Compliance Division Enforcement Program. Virginia Code and Arlington County Ordinances Residents to comply with these regulations based on the following. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Vehicles are assessed at fair market value.

Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. The Department of Accounts DOA has developed two methods for reimbursement. When do I need to register my vehicle with Fairfax County. The bills are due each year on Oct. Vehicle Personal Property Tax Relief PPTRA Annual 100 Tax on Vehicles Without Virginia License Plates.

Source: statefarm.com

Source: statefarm.com

For properties included in a special subclass the tax rate is 001 per 100 of assessed value. Directory Important Links US. So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. Classic car is defined as a vehicle that is 25 years old and older and registered annually as an everyday vehicle. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a 25000 vehicle.

Source: newsobserver.com

Virginia Code and Arlington County Ordinances Residents to comply with these regulations based on the following. A higher-valued property pays more tax than a lower-valued property. Richard E Holbert Building 9104 Courthouse Rd Spotsylvania VA 22553. Classic car is defined as a vehicle that is 25 years old and older and registered annually as an everyday vehicle. Vehicle Personal Property Tax The tax rate for most vehicles is 457 per 100 of assessed value.

Source: mitsubishi-motors.com

Source: mitsubishi-motors.com

Vehicles must be registered with the Fairfax County Department of Tax Administration DTA within 60 days of purchase or move-in to the county and are subject to the vehicle Tax. Section 581-3527 of the Personal Property Tax Relief Act stipulates that the Comptroller shall prescribe the form of reimbursement request for tax years 1999 and thereafter. Vehicle Personal Property Tax Appeals. But why does Virginia have an annual car tax that. Personal use vehicles may be eligible for the Personal Property Tax Relief Act PPTRA.

Source: mtairynews.com

Source: mtairynews.com

But why does Virginia have an annual car tax that. Joe and others correct if you have your antique car registered with antique plates or YOM plates you pay no personal property tax. Antique vehicle is defined as a vehicle that is 25 years old and older and owned solely as a collectors item. Section 581-3527 of the Personal Property Tax Relief Act stipulates that the Comptroller shall prescribe the form of reimbursement request for tax years 1999 and thereafter. This will depend upon the value of the car at the first of the year.

Source: newsobserver.com

The bills are due each year on Oct. 5 falls on a weekend or holiday. 333 would exempt all vehicles 25 years old and older from personal property taxes. You may use the following points in your message. Chesapeake prorates personal property taxes on motor vehicles.

Source: forums.aaca.org

For automobiles the NADA official used car pricing guide is used in most cases. My personal property taxes on two such licensed cars in 2014 was 175 for 69 Cutlass convertible and. 333 recognizes that existing antique motor vehicles and classic cars constitute a small portion of the vehicle fleet and are well-maintained infrequently operated hobby cars and deserving of tax benefits. So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. The bills are due each year on Oct.

Source: marottaonmoney.com

Source: marottaonmoney.com

The Department of Accounts DOA has developed two methods for reimbursement. 333 recognizes that existing antique motor vehicles and classic cars constitute a small portion of the vehicle fleet and are well-maintained infrequently operated hobby cars and deserving of tax benefits. But why does Virginia have an annual car tax that. Most recent tax relief rates are as follows. A higher-valued property pays more tax than a lower-valued property.

Source: autocarindia.com

Source: autocarindia.com

Classic car is defined as a vehicle that is 25 years old and older and registered annually as an everyday vehicle. For properties included in a special subclass the tax rate is 001 per 100 of assessed value. For automobiles the NADA official used car pricing guide is used in most cases. However if you place regular plates on an antique legally you have to do so for a daily driver although some people ignore this they may place a value on it. Section 581-3527 of the Personal Property Tax Relief Act stipulates that the Comptroller shall prescribe the form of reimbursement request for tax years 1999 and thereafter.

Source: mitsubishi-motors.com

Source: mitsubishi-motors.com

Virginia Code and Arlington County Ordinances Residents to comply with these regulations based on the following. Vehicle Personal Property Tax The tax rate for most vehicles is 457 per 100 of assessed value. Vehicle Personal Property Tax. 5 falls on a weekend or holiday. The vehicle personal property tax is a prorated tax but the 100 license tax is not.

Source: business-standard.com

Source: business-standard.com

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1. My personal property taxes on two such licensed cars in 2014 was 175 for 69 Cutlass convertible and. Assessed value of 19300 19300 x 036 69480 for 12 months Calculate personal property relief. Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1. Richard E Holbert Building 9104 Courthouse Rd Spotsylvania VA 22553.

Source: sema.org

Source: sema.org

Joe and others correct if you have your antique car registered with antique plates or YOM plates you pay no personal property tax. Active Duty Military Vehicle Personal Property Exemption. Vehicles must be registered with the Fairfax County Department of Tax Administration DTA within 60 days of purchase or move-in to the county and are subject to the vehicle Tax. Assessed value of 19300 19300 x 036 69480 for 12 months Calculate personal property relief. Tax bills are reduced by Virginia Beachs expected reimbursement under the Personal Property Tax Relief Act from the Commonwealth for qualified vehicles based on the first 20000 of value.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title personal property tax on antique car va by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Broker Fee For Selling Antique Cars

- Antique Car Show In Md Va

- Vintage Antique Car Show Fort Totten 2015

- When Can I Drive An Antique Car In Wv

- Ipswich Ford Antique Car Show 2018

- Antique Cars For Sale In Jackson Ms

- Antique Cast Iron Toy Cars For Sale

- Antique Car Shows In My Area

- Garren Auto Sales Classic Antique Car

- Car Mechanic Antique Car Kid Help Dad